Best Budget Apps For Saving Money

Saving money can be difficult, but with the help of a good money savings app, it can become much easier. A money savings app can help you track your expenses, set savings goals, and automate your savings, all in one place. With so many options out there, it can be tough to choose the best one. Here, we’ll look at some of the best money-saving apps available today.

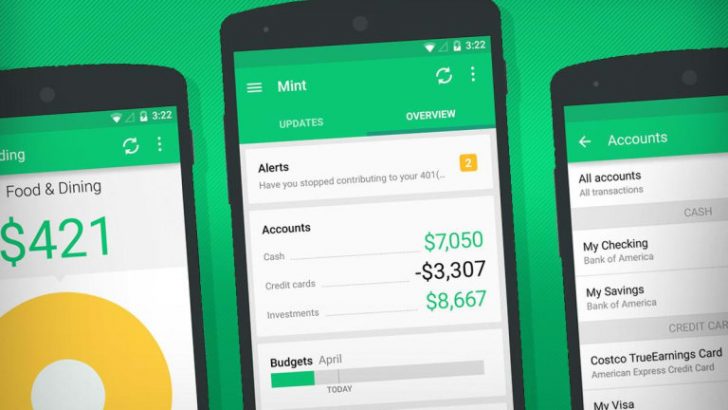

Mint

Mint is one of the most popular money savings apps out there – and for a good reason. It’s free, easy to use, and offers a variety of features to help you save money. With Mint, you can link all your bank accounts, credit cards, and investment accounts in one place to see your entire financial picture. Mint also offers personalized budgeting tools, alerts for unusual spending, and suggestions for saving money on bills.

ANNE SRADERS/ Thestreet | Many people save money and time to accomplish nothing in life

Acorns

Acorns is a unique money savings app that rounds up your purchases to the nearest dollar and invests the spare change in a portfolio of exchange-traded funds (ETFs). This means that you can start investing with just a few cents at a time. Acorns also offers a variety of other features, including automatic savings, recurring investments, and personalized investment portfolios based on your goals and risk tolerance.

Digit

Digit is a savings app that helps you save money automatically by analyzing your spending patterns and setting aside small amounts of money you won’t miss. Digit uses algorithms to analyze your income and expenses and transfers small amounts of money from your checking account to a separate Digit savings account. Digit offers features like overdraft protection and a 1% annualized savings bonus.

Costa/ App Store | Money is only a tool. It will take you wherever you wish, but it will not replace you as the driver

YNAB

YNAB (You Need a Budget) is a popular budgeting app that can help you save money. YNAB works by giving every dollar a job, so you can see exactly where your money is going and make informed decisions about where to cut back. YNAB also offers tools to help you set and achieve savings goals that can be customized to fit your specific financial situation.

Qapital

Qapital is a savings app that helps you save money by setting up customizable “rules” that trigger savings transfers based on your behavior.

For example, you can set a rule to transfer $5 to your savings account every time you go for a run or to transfer $1 to your savings account every time you buy a cup of coffee. Qapital also offers a variety of other features, including automatic savings, goal tracking, and the ability to create savings goals with friends.

Oreo Cake/ Kindpng | Save when you don’t need it, and it’ll be there for you when you do

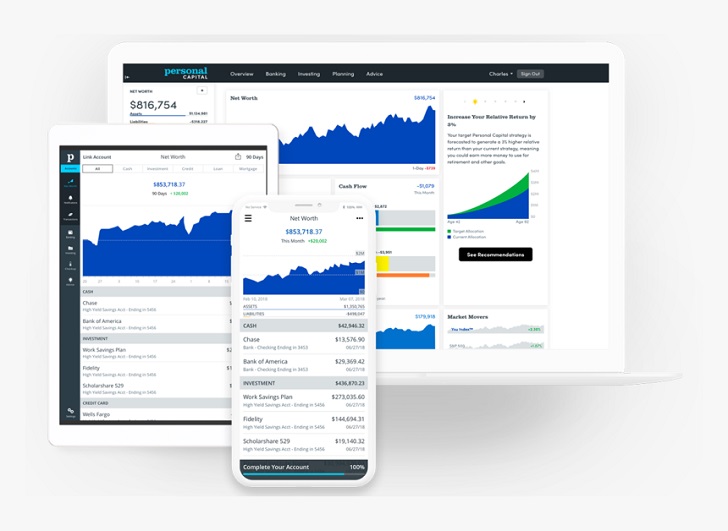

Personal Capital

Personal Capital is a comprehensive financial management app that can help you save money by giving you a complete view of your finances. With Personal Capital, you can link your bank accounts, credit cards, and investment accounts in one place and get a complete picture of your net worth, spending habits, and investment performance.

Personal Capital also offers tools to help you set and achieve savings goals and can provide personalized investment advice based on your financial situation.

More in Business

-

`

Cowboy Superstitions and Traditions That Might Surprise You

Picture this: the chute clangs open, dust plumes, and all eyes track a cowboy mid-stride. But what the crowd doesn’t see...

July 22, 2025 -

`

What’s Changing for Student Loans After Trump’s New Spending Bill?

The passing of President Donald Trump’s latest spending bill is shaking up more than just tax brackets and business deductions—it’s poised...

July 16, 2025 -

`

Why Big Tech Is Divided on the Future of Artificial General Intelligence

Fifteen years ago, the founders of DeepMind—Sir Demis Hassabis, Mustafa Suleyman, and Shane Legg—set a bold goal: “Build the world’s first...

July 1, 2025 -

`

Planning a Wedding? These Money-Saving Tips Actually Work

Weddings are meant to be memorable, not financially draining. But for many couples, the cost of tying the knot often brings...

June 24, 2025 -

`

Did MrBeast Really Borrow Money From His Mother for His Wedding?

YouTube star Jimmy Donaldson, widely known as MrBeast, sparked surprise when he shared a personal update on X. Despite leading the...

June 17, 2025 -

`

How Smart Technology Is Changing the Way We Travel

Technology has reshaped nearly every part of modern life, and travel is no exception. From how we plan trips to how...

June 12, 2025 -

`

Why Some Tech CEOs Are Replacing Themselves With AI Avatars

In a move that signals a shift in how corporate communication is handled, major tech CEOs are beginning to hand the...

June 3, 2025 -

`

Is Innovation Dead in American Pop Culture?

Has something changed in the way we engage with American pop culture? Scroll through your favorite streaming service, tune into the...

May 27, 2025 -

`

7 Key Steps to Start a Profitable Digital Products Business

Starting a digital products business offers an exciting opportunity to turn your skills and knowledge into a revenue-generating venture. Whether you’re...

May 20, 2025

You must be logged in to post a comment Login