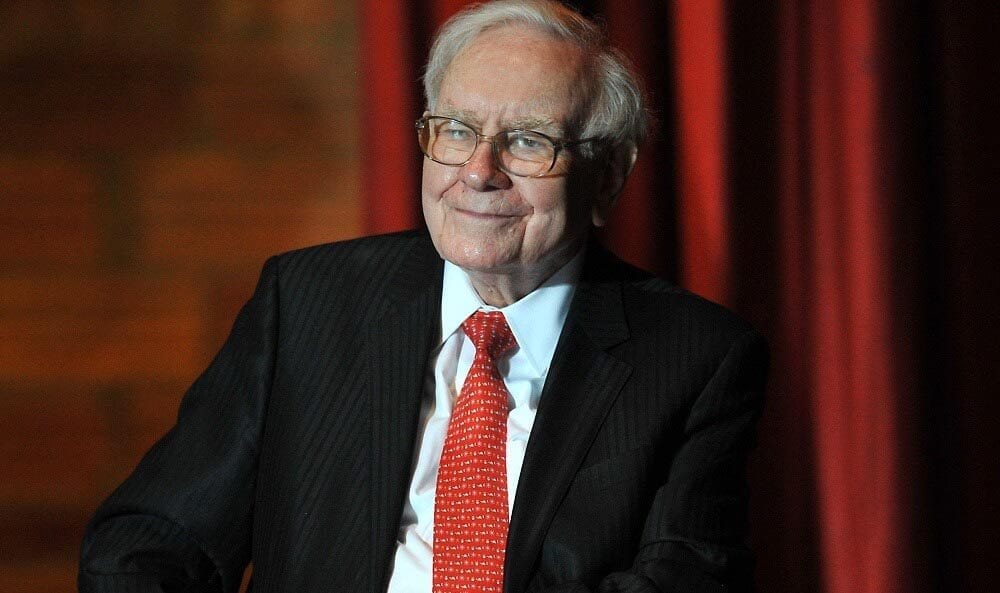

Still have no Savings at 40? Here’s How Warren Buffett can Help You with That

Starting a saving habit early on in your life will help you prepare and fund future goals from starting a family to having a comfortable retirement. But what if you reach your 40s without setting aside much money?

What can you do now to start making up for the years you prioritized other expenses be it repaying your mortgage or student loans? Billionaire investor Warren Buffett’s advice might be able to help you with that.

Boosting Your Retirement Income

Tiko Aramyan/Shutterstock: According to the AARP, most people would need about 80% of their pre-retirement income after retiring

One important part of retirement planning is ensuring that you’re able to generate enough income to fund your lifestyle even without a job. Having a pension and retirement accounts might give you substantial spending money but they might not be enough to cover every expense you may have.

If you live in the United Kingdom, it’s advised that you supplement your State Pension by investing in a long-term portfolio via a Self-Invested Personal Pension (SIPP). Doing this now would give you time to build a substantial nest egg in time for your retirement in your 60s.

Investment Strategy

Bro Crock/Shutterstock: Try to find a balance between a conservative and aggressive investment strategy to maximize returns without taking on too much risk

Speaking of investing, it’s also recommended that you diversify your money by getting into funds. Buying funds is considered to be a much safer investment compared to putting money in the stock market.

Funds offer you protection from the market’s frustration as it invests in a variety of companies in several sectors instead of just one. Those who have experience or knowledge of investing may buy shares of individual public companies and keep them in their SIPP.

From here, you can move on to try other investment vehicles such as government bonds, exchange-traded funds (ETFs), and even property. Just be sure to do the necessary research before putting your money in one.

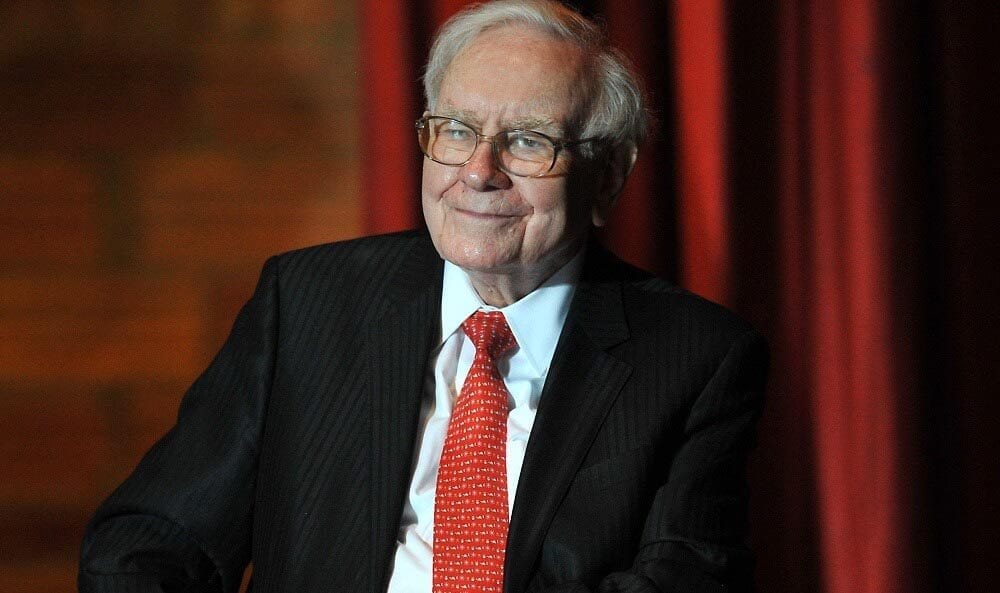

The Power of Compound Investing

Kent Sievers/Shutterstock: Buffett also encourages people to only invest in funds and companies they understand

Growing your money through investing will take years but rest assured that you would be getting your initial investment and more in the future. Berkshire Hathaway CEO Warren Buffett himself knows the power of compound investing, which means that your investment grows faster as it accrues interest throughout the years.

Doing the numbers, you can end up with a retirement nest egg of $654,003 (£505,020) by the age of 60 when you start investing $647 (£500) a month for the next 20 years. This will be the case as long as you can be sure of enjoying an effective annual rate of 12.68%.

More in Business

-

`

What Makes Human Culture Unique Compared to Other Species?

Humans have built towering cities, explored space, and developed intricate traditions, setting them apart from the millions of other species on...

April 1, 2025 -

`

Artisans Preserve the Ainu Culture in Japan Through Traditional Crafts

At the edge of Akan-Mashu National Park in Hokkaido, Japan’s northernmost island, a small village stands as a living testament to...

March 30, 2025 -

`

MrBeast’s ‘Sweet’ Side Hustle Now Earns More Than His YouTube Videos

Jimmy Donaldson, widely known as MrBeast, has built a massive empire on YouTube, amassing over 372 million subscribers. While his content...

March 24, 2025 -

`

Critics Slam Trump’s Strategic Bitcoin Reserve as “A Pig in Lipstick”

President Donald Trump has taken a significant step into the world of digital assets by establishing an official government cryptocurrency reserve....

March 22, 2025 -

`

5 Best Luxury Trains in the U.S. for an Unforgettable Journey

Luxury train travel isn’t about getting from point A to point B. It’s about the unhurried rhythm of the rails, the...

March 18, 2025 -

`

11 Signs of Luxury and Wealth in Arizona’s Millionaire Enclave

Arizona’s millionaire enclaves, particularly Scottsdale and Paradise Valley, have long been known as havens of affluence. These picturesque desert communities, nestled...

March 15, 2025 -

`

Heading Back to Work? Beware of Workplace Monitoring Systems

For many employees, returning to the office doesn’t just mean resuming in-person work. It also brings an unsettling reality—increased workplace surveillance....

March 11, 2025 -

`

Chinese Tech Stocks Hit Multi-Year Highs as AI and Earnings Drive Growth

Chinese tech stocks have been on an impressive winning streak, marking their longest rally in nearly five years. A combination of...

March 8, 2025 -

`

A Glimpse Into Mongolian Culture at the New Winter Festival

Mongolia’s harsh winter might not seem like an ideal time for a festival, but a new event celebrating nomadic culture has...

March 3, 2025

You must be logged in to post a comment Login