As Markets Decline, Climate Tech Advocates Push for Alternative Funding

Funding in climate technology didn’t vanish—it simply stopped pretending to be easy. After years of aggressive capital inflows, the sector is weathering a correction. But if you’re paying close attention, you’ll notice something: this slowdown is revealing who’s in it for the mission, and who just came for the IPO.

Why Climate Startups Struggle to Scale

If you’ve ever tried to commercialize a battery chemistry or install a solar microgrid in a regulatory maze, you already know this isn’t SaaS. Climate ventures burn through capital before revenue’s even a rumor. Hardware takes time. Permitting drags. Safety testing is mandatory. And that’s before you even hit manufacturing.

Compare that to the average tech startup that can launch with a deck, a hoodie, and a few hundred lines of code. The timelines alone create a barrier. But in climate, patience is a prerequisite—and that’s where investors start to get itchy.

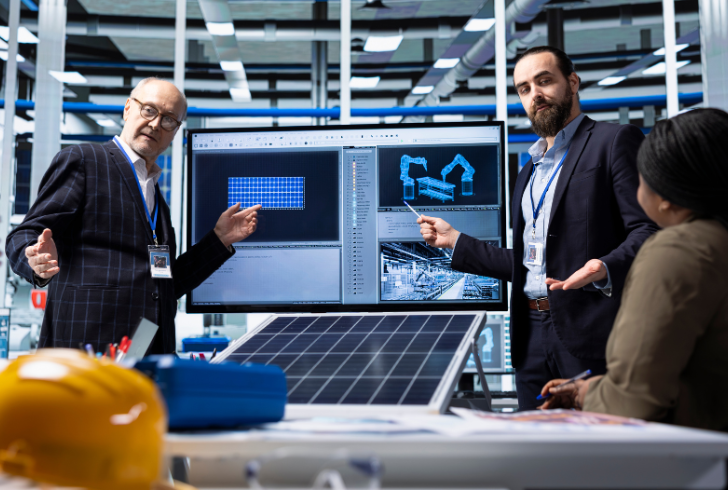

Freepik | DC Studio | Climate innovation takes time, skill, and steady investment to bring ideas to life.

What the Numbers Actually Say

Global funding for climate tech fell 19% in the first half of 2025. That’s not market collapse—that’s a recalibration. In fact, U.S. investments held steady, buoyed by a pivot toward AI-integrated solutions and infrastructure plays. What really took the hit was seed-stage capital. The willingness to back “what-if” ideas is softening, especially as macroeconomic jitters and regulatory rollbacks enter the conversation.

Still, the story isn’t all retreat. Several late-stage firms are closing strong rounds, often thanks to risk-sharing tools and blended capital models that didn’t even exist five years ago.

What’s Working (Hint: It’s Not Just Venture Capital)

Let’s talk about the funding mechanisms that are adapting to this moment, because a few are quietly rewriting the rules.

Decarbon8-US is doing something refreshingly unsexy: recycling philanthropic capital into early-stage climate tech. Think of it as a donor-powered engine. People give, startups get funding, and any returns flow right back into the fund for the next wave. No middlemen with gold-plated pitch decks—just continuous reinvestment built on shared purpose.

Then there’s Elemental’s D-SAFE model, which reimagines how early capital absorbs risk. Instead of placing all bets on one moonshot, nonprofits can fund multiple projects within a company. If something hits, the capital comes back with interest. If not, the investment converts to equity. It’s a structure designed for volatility—not against it.

Don’t overlook state-level green banks, like the one in Washington. These institutions don’t chase unicorns; they focus on closing financing gaps for shovel-ready projects. They move money where private capital hesitates, filling in the infrastructure pieces that make broader innovation possible.

Seattle, and Other Places That Still Believe

One of the perks of living in the Pacific Northwest is that the line between idealism and execution is thinner than you’d expect. Seattle isn’t just full of bright ideas—it’s full of people who’ve spent years grinding through energy policy, impact finance, and decarbonization roadmaps.

This isn’t a market chasing trends. It’s a region quietly building scaffolding. Accelerators that understand climate timelines. Philanthropists who aren’t allergic to hardware. Founders who know that success might mean five years of prototypes before anything touches a customer.

Freepik | New financial tools like D-SAFE help entrepreneurs reduce initial risk and gain investment.

Everyone with a stake in this ecosystem—investors, founders, donors, policymakers—needs to recalibrate. Market slumps create space to rethink incentives, not retreat from the table.

Investors should revisit overlooked areas like grid flexibility and low-cost electrification.

Philanthropists should treat climate capital like they do arts funding: patient, values-driven, and immune to market cycles.

Policymakers should fast-track permitting reform and reinforce green bank mandates.

Founders must get fluent in blended capital, because grants, donations, and recoverable investments may be your Series A now.

This Isn’t a Pause (It’s a Pressure Test)

What we’re seeing isn’t a decline. It’s filtration. The flashy pitch decks are fading. What’s left are people still standing in the room, sleeves rolled, still building. That’s who will shape the next decade of climate tech—not the ones waiting for market conditions to become favorable, but those building the conditions themselves.

More in Tech

-

`

Why Istanbul Is the New Celebrity Hotspot for Style and Wellness

Celebrities are constantly reinventing themselves—sometimes through a new sound, other times through a striking new look. But the latest wave of...

October 1, 2025 -

`

Is Apple Ditching the SIM Card With Its Latest iPhone?

For years, sliding a tiny SIM card into a phone has been the first step to getting connected. Apple now appears...

September 23, 2025 -

`

Why New York Nightlife Keeps Attracting Visitors Worldwide

New York comes alive after dark in a way few places on earth can match. The city never limits itself to...

September 16, 2025 -

`

How Celebrities Are Taking Over the Business World

The definition of celebrity success has expanded well past awards and sold-out tours. Today, many Hollywood names are equally focused on...

September 9, 2025 -

`

Which Foods Should You Avoid When on Holiday?

Vacations are meant to be filled with unforgettable moments, but one wrong meal can turn a dream trip into a health...

September 2, 2025 -

`

Quantum Computing Set to Give Commercial Real Estate a Major Lift

Quantum computing is no longer a concept confined to research labs. It is steadily moving toward commercial use, and with that...

August 26, 2025 -

`

Is Your Office Suffering from ‘Culture Rot’? Here’s How to Spot It

A healthy workplace doesn’t need to be perfect, but it should inspire productivity, respect, and trust. Yet, an alarming trend is...

August 19, 2025 -

`

The Small Businesses That Built Musk’s Empire Are Now Bankrupt

What looked like a dream deal for small businesses working with Elon Musk’s companies turned into a financial nightmare for many....

August 12, 2025 -

`

The $2.3 Billion Food Waste Challenge in Short-Term Vacation Rentals

Short-term vacation rentals may offer comfort, but they also come with a hidden cost—food waste. A recent study from Ohio State...

August 5, 2025

You must be logged in to post a comment Login