How Many Stock Trading Days Are There in a Year?

Ever wondered how many stock trading days in a year? For those planning their investment strategies, knowing this can be crucial. Generally, stock markets are open for trading between 250 and 252 days annually. This number isn’t fixed due to holidays, special market hours, and leap years.

Let’s explore these numbers and see how they could influence your trading plans.

Calculating Total Number of Trading Days in a Year

Weekends and Holidays

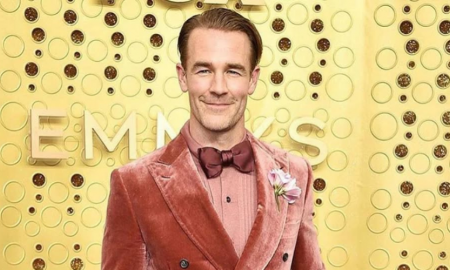

Instagram | nyse | Exchanges like NYSE and Nasdaq generally have about ten holidays annually.

The process of determining the number of trading days starts with the basics – weekends and holidays. Stock markets close on Saturdays and Sundays, reducing the number of potential trading days by 104. In addition, there are holidays like Independence Day, Thanksgiving, and Christmas, which further impact the count. Major exchanges like NYSE and Nasdaq typically observe around ten holidays each year.

Leap Years and Variations

Every four years, the calendar introduces a leap day, adding an extra 24 hours to February. Although this might seem negligible, it can impact financial markets, influencing bond yields and quarterly earnings.

Stock Market Hours and Trading Sessions

Regular Trading Hours

The NYSE and Nasdaq operate from 9:30 a.m. to 4:00 p.m. Eastern Time, Monday through Friday. These hours represent the main act of the financial markets, where the majority of trading volume and significant price movements occur.

Extended Trading Hours

Beyond regular trading hours, the market opens early and stays open late. Pre-market and after-hours trading sessions, facilitated by electronic communication networks (ECNs), allow for trading outside the standard hours. These sessions can be more volatile due to lower liquidity, offering unique opportunities for traders.

Major Stock Exchanges Around the World

Global financial markets are composed of major stock exchanges, collectively known as the ‘$1 Trillion Club.’ These exchanges command significant market capitalization and play crucial roles in the global economy. Some of these key players include:

- New York Stock Exchange (NYSE)

- NASDAQ

- Tokyo Stock Exchange

- Shanghai Stock Exchange

- London Stock Exchange

- Hong Kong Stock Exchange

- Euronext

- Toronto Stock Exchange

- Bombay Stock Exchange

- Australian Securities Exchange

US Stock Exchanges

In the US, the NYSE and Nasdaq are the primary stock exchanges. Their Monday through Friday schedule sets the rhythm for American markets, providing a predictable cadence for investors.

International Stock Exchanges

Instagram | unlucky0709 | The Tokyo and Shanghai Stock Exchanges operate on distinct schedules and cultural norms.

Outside the US, exchanges like the Tokyo Stock Exchange and the Shanghai Stock Exchange operate with different hours and cultural nuances. For example, they include a lunch break in their trading day, while others, like the Saudi Exchange, trade from Sunday to Thursday.

Optimal Trading Days and Times

Best Days of the Week for Trading

The best days for trading are often midweek—Tuesdays, Wednesdays, and Thursdays—when market movements are steadier. Wednesdays and Thursdays are particularly noted for being the most profitable days for day trading.

Best Times of the Year for Trading

Seasonal shifts also play a role. The third and fourth quarters are historically the most profitable, with the ‘Santa Claus rally’ boosting markets at the year’s end. The period between Christmas and New Year’s, though uncertain, can also be advantageous for savvy traders.

Trading Strategies and Rules to Follow

The 80/20 Rule of Trading

Freepik | tonodiaz | The 80/20 Rule indicates that most trading profits stem from a handful of key trades.

The 80/20 Rule, or Pareto Principle, suggests that a significant portion of trading profits comes from a few key trades. This principle encourages traders to focus on the most lucrative opportunities.

The 20/5 Rule of Day Trading

The 20/5 Rule advises that traders should either capitalize on early gains or cut losses by stopping their trading session if they reach 20% of their daily goal within the first five minutes. This rule emphasizes discipline and strategic planning.

Trading Days in Recent Years

The number of trading days has shown slight variances in recent years. For example:

- 2023: 252 trading days

- 2024: 251 trading days

- 2025: 250 trading days

In the financial markets, the number of trading days each year sets the stage for the trading activity. This number varies with weekends, holidays, and leap years, influencing market rhythms and opportunities. By considering the intricate details of how many stock trading days in a year, traders can better plan and execute their strategies, ensuring they are in tune with the market’s rhythms.

More in Business

-

`

Why Istanbul Is the New Celebrity Hotspot for Style and Wellness

Celebrities are constantly reinventing themselves—sometimes through a new sound, other times through a striking new look. But the latest wave of...

October 1, 2025 -

`

Is Apple Ditching the SIM Card With Its Latest iPhone?

For years, sliding a tiny SIM card into a phone has been the first step to getting connected. Apple now appears...

September 23, 2025 -

`

Why New York Nightlife Keeps Attracting Visitors Worldwide

New York comes alive after dark in a way few places on earth can match. The city never limits itself to...

September 16, 2025 -

`

How Celebrities Are Taking Over the Business World

The definition of celebrity success has expanded well past awards and sold-out tours. Today, many Hollywood names are equally focused on...

September 9, 2025 -

`

Which Foods Should You Avoid When on Holiday?

Vacations are meant to be filled with unforgettable moments, but one wrong meal can turn a dream trip into a health...

September 2, 2025 -

`

Quantum Computing Set to Give Commercial Real Estate a Major Lift

Quantum computing is no longer a concept confined to research labs. It is steadily moving toward commercial use, and with that...

August 26, 2025 -

`

Is Your Office Suffering from ‘Culture Rot’? Here’s How to Spot It

A healthy workplace doesn’t need to be perfect, but it should inspire productivity, respect, and trust. Yet, an alarming trend is...

August 19, 2025 -

`

The Small Businesses That Built Musk’s Empire Are Now Bankrupt

What looked like a dream deal for small businesses working with Elon Musk’s companies turned into a financial nightmare for many....

August 12, 2025 -

`

The $2.3 Billion Food Waste Challenge in Short-Term Vacation Rentals

Short-term vacation rentals may offer comfort, but they also come with a hidden cost—food waste. A recent study from Ohio State...

August 5, 2025

You must be logged in to post a comment Login