How To Supercharge Your Expenses In 2023: Here Are 4 Tips From Money Experts

Adopting good money-handling habits can help you set off right in 2023. Financial problems are solved quickly if they are dealt with efficiently and with certain fixed goals. Many people cannot take some time from their super-packed and busy daily routines and are forced to afford the consequences of poor money management. To save yourself from that crisis, you need good planning to improve your handling of money.

Here are four easy ways to supercharge your finances:

Build an emergency fund

FINFIRST/ First Bank | Learn to budget and understand your finances

You can never predict the kind of emergency and when it will arise – leading you to withdraw an unexpectedly large sum that could otherwise cover six months of your expenses. Emergencies could include car repair, fixing the heater or air conditioner of your house or car, medical crises, private schools, college expenses, and even possible pandemic crises.

You could deposit around fifty bucks every day to your emergency savings. If you’re not financially stable, you could also add five dollars daily to protect yourself from an emergency crisis turning into a personal crisis and putting your plans and financial stability in jeopardy.

Cut it in half

Freepik/ Iconscout | Money decisions are tough—you can neither spend without guilt nor save without sacrifice

Many financial goals focus on the bigger picture, such as buying a house, cruise, yacht, or traveling to your dream location. Saving for such goals can be challenging, especially to keep saving along with your daily, weekly, and monthly expenses that often go up and down. In this case, divide your money monthly according to the period you wish your goal. For example, if your goal is to purchase a property within the next six months and your budget is $12k. You could set aside $2k per month from your earnings to fulfill your goal.

Create a budget

Budgeting is a great technique to get you to control your finances. To get a vivid understanding and knowledge of your budget, you can calculate your expenses for the previous year. Look where and how much you have spent every month, and create a budget by combining all the added expenses.

This would help you figure out where you are spending, and you can easily start planning your goal according to that. You can also upgrade your budget according to your desired spending. But always monitor where your money is going. Don’t waste on unnecessary things that you can easily live without.

Rawpixel/ Pinterest | Don’t go broke trying to look rich

Check your credit score and report

Your credit score can impact your monthly interest rate. There are often errors in credit card resorts, such as unpaid bills or loans. If you don’t catch these kinds of mistakes sooner, then you could end up paying a higher interest rate on your mortgage, loans, or debts. You could even be at risk of having your credit card blocked. Credit scores have similar issues and errors that can be easily removed by contacting your credit bureaus.

More in Business

-

`

George Clooney Lists Lake Como Villa for $100 Million

Nestled on the picturesque western shore of Italy’s stunning Lake Como sits Villa Oleandra, an 18th-century masterpiece owned by none other...

November 19, 2023 -

`

Amazon Buys a Big Stake in A.I. Start-Up Anthropic

In a strategic move to stay competitive in the rapidly evolving landscape of artificial intelligence (A.I.), Amazon has announced a massive...

November 12, 2023 -

`

Nina Dobrev and Julianne Hough Talk Future of Their Wine Company

Nina Dobrev and Julianne Hough show no signs of slowing down in their wine adventure, Fresh Vine Wine. Despite its relatively...

November 1, 2023 -

`

Web3: The Future of the Internet

The internet has come a long way since its inception, and blockchain technology is pivotal in its ongoing evolution. In this...

October 26, 2023 -

`

Kim Jong-Un’s Lavish Travels: Inside the Supreme Leader’s Armored Train

When discerning the movements of North Korea’s enigmatic leader Kim Jong-un, Western spies often turn their eyes to a peculiar and...

October 19, 2023 -

`

FaZe Clan: Navigating the Challenges of Fame and Finance

In the dynamic world of esports and online content creation, FaZe Clan once stood as the embodiment of youthful culture and...

October 12, 2023 -

`

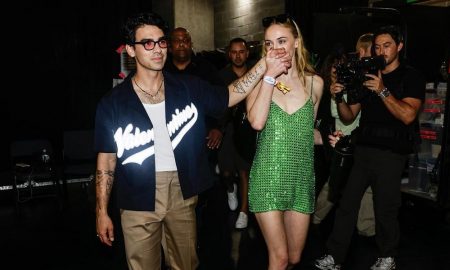

Joe Jonas Opens Up After Filing for Divorce

In the world of glitz and glamour, even the most seemingly perfect unions can sometimes shatter into fragments. Joe Jonas, the...

October 6, 2023 -

`

Why Apple’s View of the Future Is a Lonely One

Imagine a world where your reality is your own and defined by screens – isolated yet connected. It’s 2025, and you...

September 26, 2023 -

`

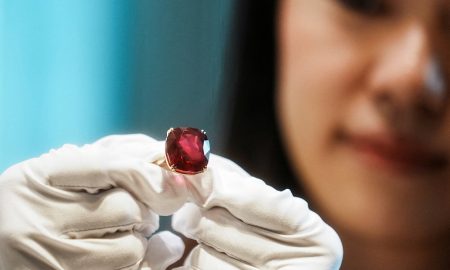

The Record-Breaking Ruby: The $34.8 Million The Estrela de Fura

In a dazzling display of luxury and rarity, a remarkable 55.22-carat ruby recently soared to unprecedented heights in gem auctions, commanding...

September 24, 2023

You must be logged in to post a comment Login