What’s Changing for Student Loans After Trump’s New Spending Bill?

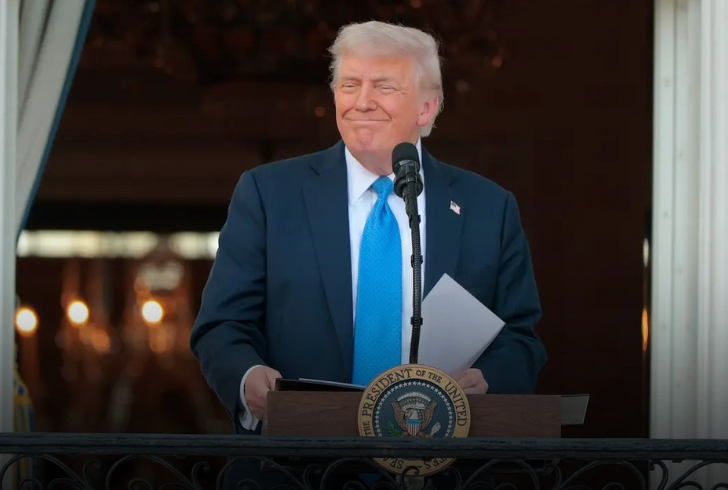

The passing of President Donald Trump’s latest spending bill is shaking up more than just tax brackets and business deductions—it’s poised to significantly reshape how Americans borrow and repay federal student loans. With the bill just a signature away from becoming law, students, parents, and future graduates are closely watching what’s changing and how it could affect their financial plans.

This nearly 900-page legislation isn’t just about permanent tax cuts. It carries sweeping changes across multiple areas—scaling back social safety nets, trimming clean energy incentives, and introducing strict new rules for federal student loans. Let’s break down exactly what’s coming and who needs to prepare for impact.

New Borrowing Limits

For many, the dream of higher education could become harder to fund. One of the most noticeable changes is the introduction of borrowing caps:

1. Graduate students will face a lifetime borrowing limit of $100,000.

2. Those pursuing degrees in law or medicine will see a higher limit of $200,000.

3. Parents using Parent PLUS loans will be capped at $65,000—a major shift for families trying to bridge the tuition gap.

Instagram | businessinsider | The Trump bill introduces new rules for student loan amounts and their repayment.

These caps significantly cut down on borrowing flexibility, especially for students planning to attend high-cost institutions or professional programs. Part-time students also face new limitations, as the bill curbs lending options and reduces access to deferment or forbearance opportunities.

A Major Shake-Up in Repayment Options

Trump’s bill doesn’t just change how much students can borrow—it rewrites the rules on how they’ll pay it back.

Gone are the days of multiple income-based repayment plans that allowed borrowers to scale their payments to match their financial situation. Under the new law, only two repayment plans will be available:

1. Standard Repayment Plan

Fixed monthly payments based on the total loan balance, spread over 10 to 25 years.

2. Repayment Assistance Plan

Payments will range from 1% to 10% of discretionary income, which still offers some flexibility but is a step back from the broader protections under Biden-era plans.

These changes could hit lower-income borrowers the hardest, especially those who previously qualified for generous income-driven options or loan forgiveness after consistent payments.

What Happens to the SAVE Plan?

The Saving on a Valuable Education (SAVE) plan, launched during the Biden administration, currently has around eight million enrollees. But under the new legislation, its future hangs in the balance.

Here’s what’s outlined:

1. Borrowers must switch to one of the new repayment plans between July 2026 and June 2028.

2. Anyone who hasn’t transitioned by July 1, 2028, will be automatically moved into the new Repayment Assistance Plan.

This creates a confusing window for borrowers, many of whom are still uncertain about the program’s long-term legality, as it remains tied up in the courts.

Parents Face Tougher Choices

The Parent PLUS loan program sees a dramatic overhaul in the bill. Along with the newly imposed $65,000 cap, these loans will no longer qualify for income-based repayment plans. That means parents helping to finance their children’s college education may need to rely more on savings or private loans with less favorable terms.

This change narrows the financial options available to middle-class families, especially those with multiple children in school at the same time.

Who’s Most Affected?

Freepik | Students starting undergraduate programs soon will find a new loan landscape after the bill is enacted.

The bill mainly targets new borrowers, so current borrowers, especially those who’ve locked into older repayment plans, may not feel the full impact immediately. However, for anyone planning to take out loans after the bill becomes law, the landscape will be very different.

That includes:

– Students entering undergraduate programs in the next few years

– Graduate and professional degree candidates

– Parents hoping to support their children through federal lending

Anyone in these groups will need to revisit their long-term education financing strategies.

What This Means Moving Forward

Trump’s spending bill isn’t just about tax code tweaks—it introduces a sharp turn in federal education financing. The bill changes how families plan, borrow, and repay college costs by slashing borrowing caps, limiting repayment options, and replacing income-based models.

As the bill awaits Trump’s signature, it’s vital for future borrowers to stay informed. The new system reduces flexibility, increases personal financial responsibility, and puts more pressure on borrowers to make careful, informed decisions about their education and careers.

Stay tuned as the policy unfolds, and consider reaching out to student aid advisors to understand how these shifts may impact individual borrowing options in the coming years.

More in Business

-

`

AI May Soon Replace Apps, Says Meta’s Chief Technology Officer

The way people interact with technology could soon see a major shift, one that changes daily habits without most even realizing...

May 6, 2025 -

`

Donald Trump’s Role in Changing the Face of American Culture

Changes in American politics often bring cultural aftershocks, but the shifts under President Donald Trump have reached deep into the core...

April 29, 2025 -

`

4 Questions Every Investor Should Ask During Market Turmoil

Markets don’t crash quietly. Sudden drops and rebounds cause confusion, panic, and emotional decisions. This week’s wild market swings felt less...

April 21, 2025 -

`

Inside the Lives of Millionaires Who Choose to Spend Less, Not More

Living with a million-dollar net worth doesn’t always look the way most people expect. Instead of flashy lifestyles and luxury cars,...

April 15, 2025 -

`

India’s Growing Role in Global Tech Governance

Technology is at the heart of modern economies, shaping industries, communication, and daily life. For years, the United States and China...

April 7, 2025 -

`

Do Babies Really Need High-Tech Gear? A Parent’s Honest Review

As technology continues to evolve, it’s no surprise that the world of baby gear has also embraced the latest innovations. Many...

April 5, 2025 -

`

What Makes Human Culture Unique Compared to Other Species?

Humans have built towering cities, explored space, and developed intricate traditions, setting them apart from the millions of other species on...

April 1, 2025 -

`

Artisans Preserve the Ainu Culture in Japan Through Traditional Crafts

At the edge of Akan-Mashu National Park in Hokkaido, Japan’s northernmost island, a small village stands as a living testament to...

March 30, 2025 -

`

MrBeast’s ‘Sweet’ Side Hustle Now Earns More Than His YouTube Videos

Jimmy Donaldson, widely known as MrBeast, has built a massive empire on YouTube, amassing over 372 million subscribers. While his content...

March 24, 2025

You must be logged in to post a comment Login